Expert explains: is it safer to pay online with a credit card?

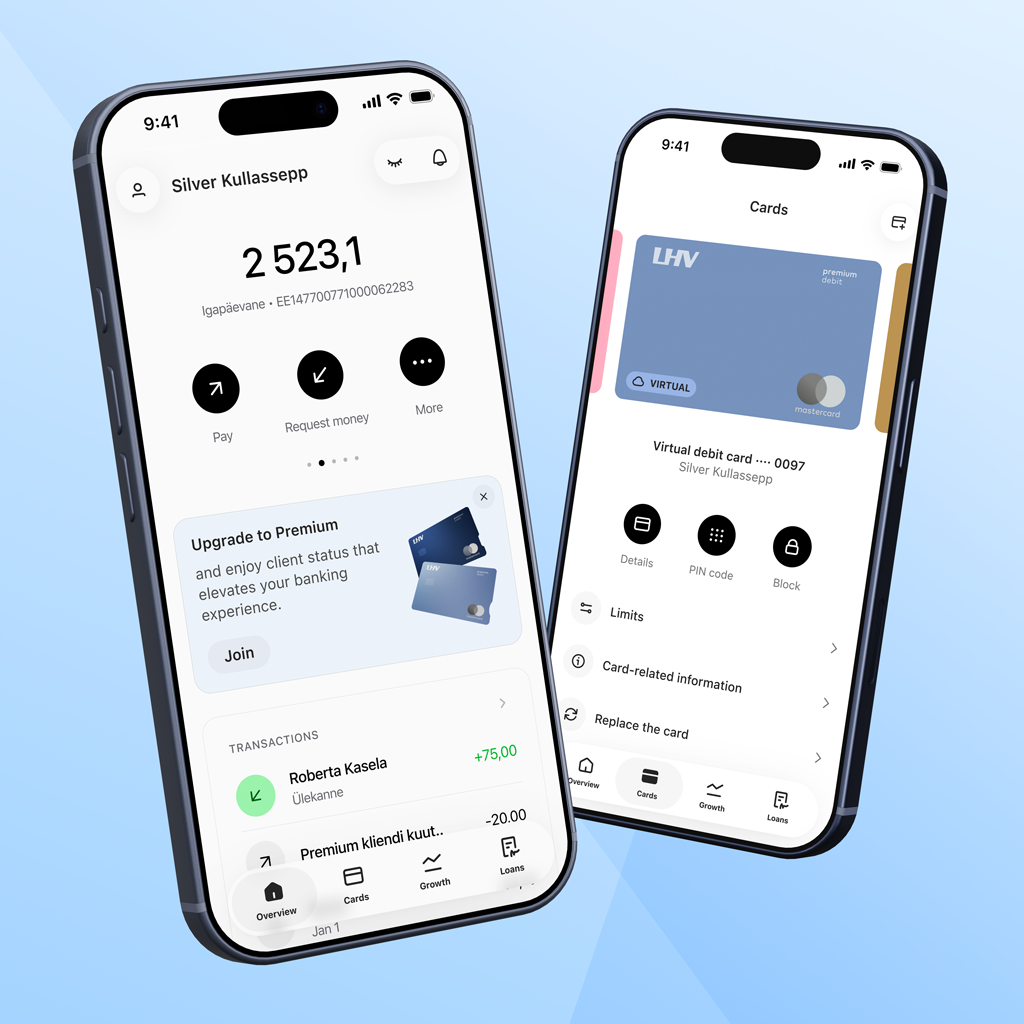

21. october 2024Although the functionality of debit and credit cards is quite similar nowadays, many people are still wary of credit cards and prefer to use debit cards for daily finances. However, matters involving cards are often not so black and white. Annika Goroško, the Head of Retail Banking at LHV, explains what to consider when choosing a bank card and shopping online.

It is known that one of the main differences between a debit and a credit card is the credit limit: this is the amount that can be spent with a credit card without actually owning it. Generally, debit cards issued by banks have the functionality of a credit card, therefore, it can be used to pay in the same places as with a credit card. With a debit card, you simply use your own available funds, and with a credit card, you use the bank’s money, which is why a credit card is mostly used for larger or unexpected purchases that require flexibility to repay. However, there are some differences when it comes to buying.

Check whether the card has purchase insurance

Nowadays, you can generally do everything with a debit card that you can do with a credit card: for example, use it to shop online or book a hotel, rent a car, and for other activities that once required a separate credit card. However, the difference between credit cards and debit cards becomes apparent when travelling, as some service providers in foreign countries consider credit cards more reliable than debit cards. For example, in southern Europe or the United States of America, you may not be able to rent a car or book accommodation without a credit card. Although most banks offer the same payment functions for debit and credit cards, old perceptions continue to persist.

When shopping online, both credit and debit cards are covered by secure online shopping protection, and some bank cards also come with purchase insurance, thus, when paying for larger purchases, it is worth making sure you use a card that is covered.

However, some differences occur, for example, if there is a problem with the order from the online shop. Let us say that you have ordered a product from an online shop and paid for it with a credit card. If the goods do not arrive or the merchant does not solve the problem, you can contact your bank and start the recovery process. However, this can take up to 90 days. If you paid with a credit card, you do not have to ‘lock up’ your personal money for the duration of the dispute because you made the purchase on credit. By contrast, a debit card purchase will have all the money ‘stuck’ in the current account at the time of the dispute, which may affect the daily budget.

Differences in fraud cases

There are also differences in fraud cases: if credit card details fall into the wrong hands, criminals can only use the credit card limit, as it is separate from the current account. In the case of a debit card, criminals have access to a person’s current account and the available money on it. As the current account can have a higher balance and often contains savings, the damage can be greater and emotionally more difficult to bear in the event of debit card fraud. A credit card can therefore offer more peace of mind and a quicker solution in this case.

In the case of a credit card, you should be aware that the credit limit used is the bank’s money, which will have to be repaid later. If a person has entered into a credit card agreement and ordered the card, they are not obliged to use the credit limit: in most cases, an interest-free period of up to 40 days can be used with credit cards. This means that if you repay the full amount of credit used before the end of the period, there are no additional charges. You can also generally top up your credit card account with your own money, for example, if you need to spend more than your credit limit to buy airline tickets.

In addition to online shopping, it already depends on the specific card whether it comes with other additional features. For example, some credit cards may come with travel insurance or motor own damage insurance for rental cars. With this in mind, it makes more sense, and is somewhat safer, to use a credit card for people who are active travellers and shoppers, although a debit card will suffice in other cases.