LHV Pensionifond M

Suitable if

- you have 3–10 years left until retirement age,

- you have moderate risk tolerance,

- your aim is the long-term stable growth of your pension savings.

A stable choice in M

- The M fund’s investment strategy focuses on assets that generate a steady cash flow: real estate and bond investments.

- For bond investments, we have focused on Estonian companies. This has given the fund a significantly higher rate of return over the past seven years, compared to the global bond markets.

- M is actively managed, which is why the risks are managed and the pension saver’s money is kept safe. Our investment team makes decisions based on thorough analysis and the economic situation.

Romet Enok

Fund Manager at LHV

„Unstable times have shown that LHV pension fund M’s strategy has proven its worth: investments with a stable rate of return have protected and grown the assets of pension savers even in a market in decline.“

Biggest investments

The data is presented as at 31.03.2025

| Biggest investments | |

|---|---|

| Eesti Energia perpetual NC5.25 | 6.81% |

| France Treasury Bill 25/05/2025 | 6.17% |

| Luminor 7.75% 08/06/2027 | 5.05% |

| Deutschland 1.0% 15/08/2025 | 4.46% |

| ZKB Gold ETF | 4.17% |

| German Treasury Bill 18/06/2025 | 3.58% |

| EfTEN Real Estate Fund | 3.53% |

| East Capital Real Estate Fund IV | 3.02% |

| SG Capital Partners Fund 1 | 2.80% |

| EfTEN Real Estate Fund 5 | 2.63% |

Biggest investments in Estonia

| Biggest investments in Estonia | |

|---|---|

| Eesti Energia perpetual NC5.25 | 6.81% |

| Luminor 7.75% 08/06/2027 | 5.05% |

| East Capital Real Estate Fund IV | 3.02% |

Asset Classes

Information about the fund

| Information about the fund | |

|---|---|

| Volume of the fund (as of 31.03.2025) | 105,612,957 € |

| Management company | LHV Varahaldus |

| Equity in the fund | 300,000 units |

| Rate of the depository’s charge | 0.0427% (paid by LHV) |

| Depository | AS SEB Pank |

Entry fee: 0%

Exit fee: 0%

Management fee: 0,6120%

Success fee: Performance fee is 20% of the positive difference between the fund's performance and the benchmark, maximum of 2% per annum of the fund's volume.

Ongoing charges (inc management fee): 1.14%

The ongoing charges figure is an estimate based on the current management fee and the 2024 level of all other recognized costs. Ongoing charges may vary from year to year.

Terms and Conditions

Prospectus

March 2025: Stable Results Despite Tariffs

Kristo Oidermaa and Romet Enok, Fund Managers

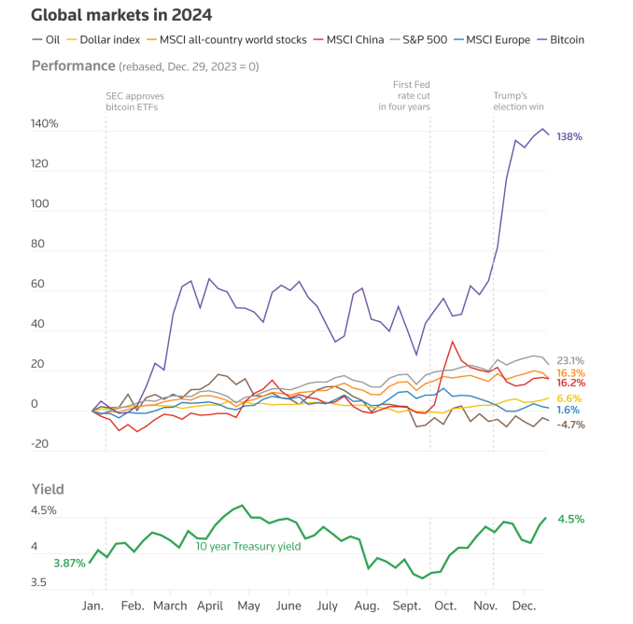

Developed markets ended March in negative territory, anticipating a trade war escalation, which subsequently materialised in early April. The S&P 500 fell by 5.8% in dollar terms, while the European Euro Stoxx 50 declined by 3.8% in euro terms. The emerging markets index remained relatively unchanged, rising 0.4% in dollar terms. Its largest constituent, China, gained 2% over the month. The OMX Baltic Benchmark index rose by 1.6%.

In March, Estonian startup Blackwall (formerly Botguard) announced the successful completion of a €45 million Series B funding round. The round was led by Dawn Capital, a European venture capital firm specialising in B2B software, with participation from existing investors such as MMC and Tera Ventures. Blackwall develops AI-based security and web infrastructure solutions and already has a footprint in several regions across the globe – its software currently protects over 2.3 million websites, with plans to expand into the US and Asia in the near future.

One of our key direct investments is nearing completion, as Lithuania’s Šiaulių Bankas has announced the repayment of the bond held by LHV funds. The bond pays an annual interest rate of 6.15% and was part of our broader investment in subordinated bonds issued by Baltic banks – Coop, Citadele and Šiaulių. The first two have already redeemed their bonds earlier.

February 2025 The portfolio was supplemented with bank securities

Kristo Oidermaa and Romet Enok, Fund Managers

February was quite volatile due to Donald Trump’s inauguration. The US S&P 500 index declined by 1.4% in dollars over the month. The Euro Stoxx 50 index rose by 3.4% in euros. The Emerging Markets Index gained 0.4% in dollars, with China’s market rising by 11.7%. The OMX Baltic Benchmark Index climbed 3.2% over the month.

EfTEN Kinnisvarafond II sold the Kaunas Terminal Logistics Complex in February to the Lithuanian asset management firm Prosperus. The transaction was valued at 18.2 million euros. The complex covers 28,737 square metres and is located in a key industrial area. Prosperus is one of Lithuania’s largest real estate investors and is known for its strategic investments in high-potential properties across the Baltic region.

We expanded our bond portfolio with securities from two banks in the region. At the beginning of the month, we acquired five-year bonds of Poland’s major bank Pekao on the secondary market, with an expected annual yield of approximately 4%. Additionally, we participated in the primary issuance of subordinated bonds for the European market by Luminor Bank. These perpetual bonds carry an annual interest rate of 7.375% and are callable in six years. This was also one of our portfolio’s most notable movers in February – by the end of the month, these bonds had gained nearly 2% in value in addition to accrued interest. The key question for the bond market at the moment is whether the European Central Bank will continue cutting interest rates after early March. At the same time, bond prices – particularly for companies with relatively weaker credit ratings – have risen significantly.

January 2025: The year started strong in the stock markets

Kristo Oidermaa and Romet Enok, Fund Managers

The year started strong in developed markets. The US S&P 500 index ended January with a return of +2.7% in dollar terms, while the European Euro Stoxx index gained 8.1% in euros. The emerging markets index rose 1.7% in dollar terms, with its largest constituent, China, increasing by 0.6%. The OMX Baltic Benchmark index climbed 5.3% in euros over the month.

In January, the private equity fund INVL announced an agreement to sell InMedica Group, Lithuania’s largest private clinic and hospital network, to Mehiläinen, Finland’s largest healthcare provider. The transaction will be finalised once it receives approval from competition authorities in both countries. InMedica serves more than 2.7 million patients annually across 89 facilities in Lithuania, Finland, Sweden, Germany and Estonia, generating over €150 million in annual revenue. Mehiläinen, with a 115-year history, and operations in Finland, Sweden, Germany and Estonia, aims to strengthen its position in the Baltic region, where the healthcare market is experiencing rapid growth.

Latvia’s Citadele Bank repaid its subordinated bond issued in 2017. The bond was listed on the stock exchange, but LHV pension funds remained an anchor investor throughout, as part of our 2016–2019 investments in subordinated bonds from local Baltic banks – Siauliu in Lithuania, Citadele in Latvia, and Coop and Bigbank in Estonia. Over this period, Baltic banks have expanded their businesses and market shares, while also developing a public market for their subordinated bonds. Pension funds earned strong interest from these and contributed to the growth of the local financial sector.

December 2024: Markets show signs of calming

Kristo Oidermaa and Romet Enok, Fund Managers

Following November’s “Trump rally”, December saw a slight pullback, with S&P 500 ending the month down 2.5% in dollar terms. By contrast, the Euro Stoxx 50 index rose by 1.9% in euro terms, while the Emerging Markets index was nearly flat, posting -0.3% in dollar terms. Among emerging markets, Brazil was the biggest decliner, but this was offset by China, which rose by 2.6% in dollar terms. The OMX Baltic Benchmark index also increased by 1.6% for the month.

At the end of 2024, private equity funds were quite active. KJK Funds sold one of their largest investments, Don Don, a Balkan-based bakery chain, to Grupo Bimbo, a globally renowned Mexican baked-goods giant. Don Don, which began operations in 1994 in Slovenia, has steadily expanded into Croatia, Serbia, Bulgaria and several other European countries. The deal provided Grupo Bimbo with access to new markets.

In the bond portfolio, Citadele Bank announced to the stock exchange that it plans to redeem its subordinated bond issued in 2017 in January. This news fittingly concluded a year during which the fund exited several bond investments both in Estonia and across European markets.

A dizzying rise in the US stock markets

Andres Viisemann, Head of LHV Pension Funds

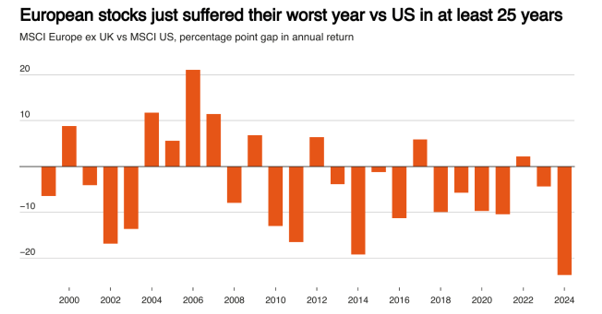

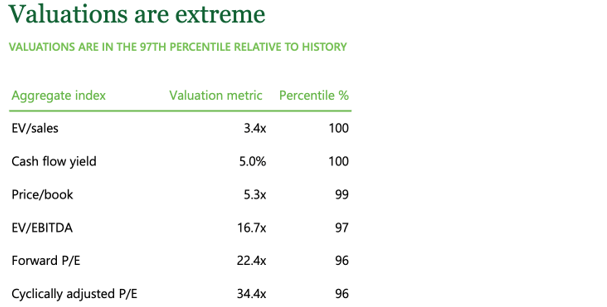

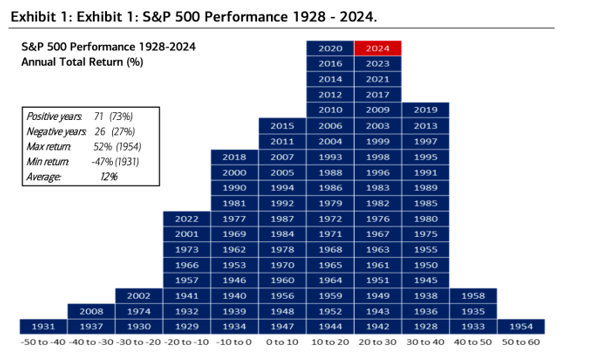

The year 2024 turned out to be unexpectedly strong for financial markets, with the MSCI World Index, which tracks the performance of developed country stock markets, gaining 19.2%. This was primarily driven by an extraordinarily powerful rise in US stocks. Since the share of US companies in the World Index is nearly 74%, it is understandable why the global stock market index performed so well.